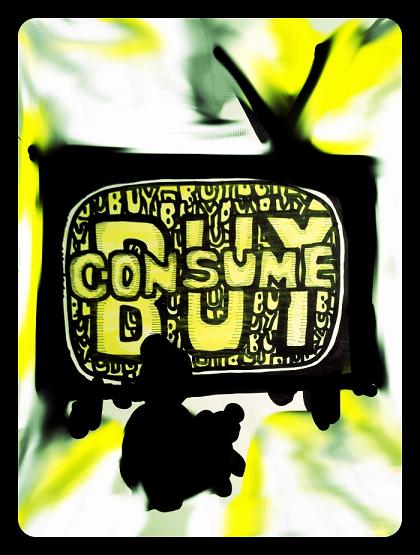

[dropcap style=”font-size:100px; color:#992211;”]B[/dropcap]uy consume buy buy, consume, buy, spend, spend. Spend NOW!

Because you may be dead soon.

Late-stage capitalism enters endgame.

As often as we hear these clichés, they might include some real economic wisdom for some, according to research led by Princeton University’s Woodrow Wilson School. The researchers argue in the Journal of Mathematical Economics that some people might want to spend more and work less – just in case their time runs out.

(Video NSFW)

Spend more and work less

Marc Fleurbaey, the Robert E. Kuenne Professor in Economics and Humanistic Studies and professor of public affairs, and his collaborators – Marie-Louise Leroux from the University of Quebec and Gregory Ponthiere from the Paris School of Economics – examined an inequality that is not often under the spotlight: those who live long, fruitful lives and those who die early.

[quote]The only way in which inequalities

between short- and long-lived can

be attenuated is by having everyone

spend a little more and work a little

less early in life[/quote]

The researchers argue that a premature exit from life is a serious loss that should imply compensation not just to relatives but also to the deceased person. But how – when the person is dead?

To evaluate compensation, the researchers first determined the economic losses associated with living too short of a life. They constructed a mathematical model that measured the loss of an early death in terms of an equivalent loss in income or consumption. By analyzing these measures, the researchers could compare the usual economic inequalities to the inequalities due to premature deaths.

Short lives result in big losses

To test their model, the researchers used data on income and longevity and France to examine four socio-professional groups: executives, professionals, blue-collar workers and clerks from age 20 to 100. Under the assumption that each individual lived the same amount of time, the researchers found that, unsurprisingly, those with the lowest income (clerks) are the worst off in terms of financial losses – for instance, their income is 30 percent lower than the professionals. But, across the four groups, those who die at age 55 lose, on average, the equivalent of 40 percent of income compared to those who live until age 85. In sum, short lives result in big losses, comparable to the gaps between socio-economic groups.

“The only way in which inequalities between short- and long-lived can be attenuated is by having everyone spend a little more and work a little less early in life,” said Fleurbaey. “That way, for those who are unlucky and die prematurely, their life is not as bad economically as it would be if they had planned to enjoy more consumption and leisure later.”

All that money squirreled away

While the authors do not argue that savings should be curbed – savings are famously low in the United States – they claim that the usual concern about under-saving may be partly assuaged by considering the problems that come with an early death. Decades ago, programs like Social Security and public pensions came about so that a person’s declining years were not spent in grinding poverty, which, in the 18th and 19th century was an issue; people literally landed in the poorhouse. Now, thanks to growing affluence, there is an opposite risk: not living long enough to enjoy all that money squirreled away.

“Through economics and psychology, we’ve learned that people are not rational when it comes to money, leading people to save too little. But saving a little less may be good for some, as it curbs the inequality that exists between the short- and long-lived,” said Fleurbaey. “Likewise, the tradition of encouraging savings, which comes from an era of scarcity but remains strong today, appears somewhat ill-adapted in the context of affluence. Suppose you spend your whole life saving and saving for retirement, but you die the year before you retire. On an individual level, you might have been better off if you consumed more, earlier in life.”

Source: Princeton University, Woodrow Wilson School of Public and International Affairs

Photo: Ticiana Jardim Marini

Illustration by Dan Booth not to be reproduced without his express prior permission

Some of the news that we find inspiring, diverting, wrong or so very right.

![L'Esprit comique [Der komische Geist], René Magritte, 1928. Courtesy Sammlung Ulla und Heiner Pietzsch, Berlin © 2025, ProLitteris, Zurich Photo Credit: Jochen Littkemann, Berlin](https://b276103.smushcdn.com/276103/wp-content/uploads/2025/07/ew11_0098489_2025-05-12_web-140x174.jpg?lossy=1&strip=0&webp=1)